Payroll

Eliminate the Overhead

SERVICES

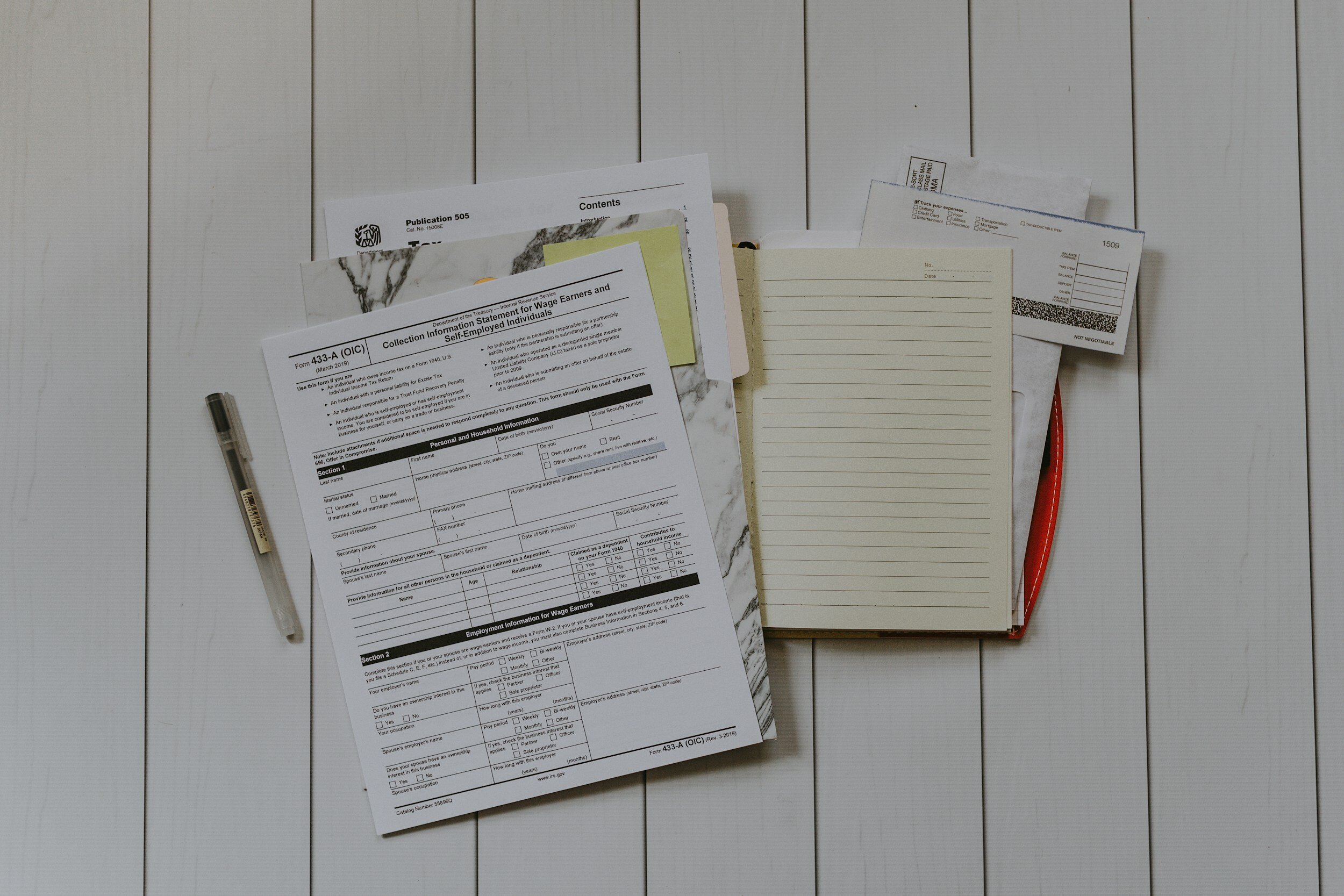

Payroll Administration

Running your own payroll is exhausting and can be an unprofitable use of your time and resources. It also requires an extensive amount of expertise to navigate the constantly changing tax and employment laws – which differ from state to state.

Our payroll administration service eliminates virtually all of the overhead required to run your own payroll. Our expert HR staff can take care of it all, from properly classifying employees to coordinating all tax reporting, including year-end W2s and 1099s. From wage garnishments to federal tax liability withholding, we’re here to handle it for you.

Prompt Processing

& Delivery

One of the most important aspects of running a business is making sure employees are paid on time. If employees aren’t paid promptly, they will quit, leaving your company in the lurch. We provide top-notch payroll processing services that cover everything from employment eligibility forms to cutting checks.

We offer direct deposit and direct debit of your chosen bank account for payment. If you or your employees prefer check processing, we offer multiple shipping and delivery options. We handle complex payroll deductions, ensuring all taxes are properly withheld and submitted.

Payroll Records Management & Reporting

Our highly flexible payroll reporting is customized based on your specific needs. Our detailed reports will help the decision-makers at your business. We also offer import/export options for all payroll data to make records management smooth and seamless.

-

We ensure your employees get paid on time so you don’t have to worry about it.

-

We handle all your tax forms and reporting, ensuring compliance with state and federal laws.

-

Never worry about taxes again – we ensure timely deposits.

-

Reduce and eliminate the potential for audits with our professional payroll services.

-

When employees owe the IRS, we handle their wage garnishments for you.

-

We can handle all official inquiries into employee wages.

-

As a benefit to your employees, we offer direct deposits for wages.

-

We’ll provide comprehensive payroll reports on a regular basis for your review.

Ready to Get Started?

Empower your business alongside thousands of others as you elevate your HR management with us.